Stack cash, cover the difference

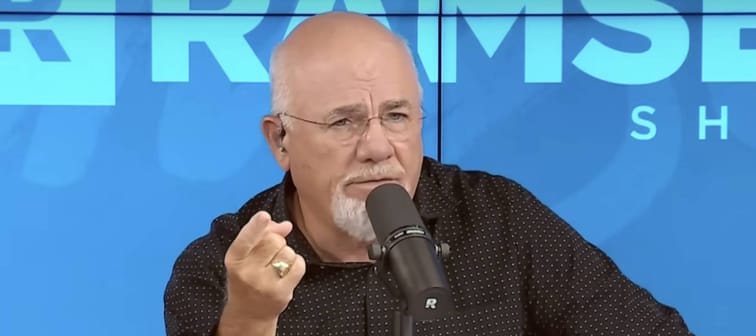

One of the ways to deal with an underwater asset, according to Ramsey, is to “stack cash and cover the difference.” Essentially, cutting back on expenses and boosting income should help David and his wife accumulate enough capital to close the gap between their auto loans and the market value of their vehicles.

Unfortunately, David recently lost his job, making it difficult to implement this strategy right away. Meanwhile, the debt burden is immense. David and his wife must pay $852 a month for his truck, $677 for her SUV, and $555 and $408 respectively for two motorcycles. Altogether, the couple needs roughly $2,500 a month to cover these payments but currently live on a single salary and unemployment benefits.

“I know you lost your job but right now is not the time to wait for your dream job to come along,” said co-host Jade Warshaw. “Right now get any jobs you can.” Ramsey wanted him to consider ride sharing or food delivery. “You can drive because you've got a lot of things to drive,” he said dryly.

Kiss your credit card debt goodbye

Millions of Americans are struggling to crawl out of debt in the face of record-high interest rates. A personal loan offers lower interest rates and fixed payments, making it a smart choice to consolidate high-interest credit card debt. It helps save money, simplifies payments, and accelerates debt payoff. Credible is a free online service that shows you the best lending options to pay off your credit card debt fast — and save a ton in interest.

Explore better ratesBorrow the difference

David could also borrow funds to cover the difference between market value and purchase price. Ramsey encouraged him to seek out a loan from a credit union or other lenders. He can then use the money in conjunction with the proceeds of selling the vehicles privately to pay off the auto loans in full.

Debt consolidation like this is a common strategy, according to TD Bank. Borrowers usually tap into their home equity or apply for personal loans to pay off debt that’s either too expensive or due imminently (though using home equity carries its own risks).

This strategy also hinges on the borrower’s creditworthiness and income, thus David’s current unemployment could complicate this strategy.

Negotiate with the lender in person

Ramsey’s final suggestion is to negotiate with the auto lender directly. David’s auto loan might be held at a local bank or credit union where the manager is willing to consider an alternative: an unsecured note for the difference between the loan amount and the resale value of these vehicles.

It is essential, Ramsey told David, that this be done “in person, not on the phone and for God sakes not by email! Go sit down and look ‘em in the eye.” Restructuring or refinancing debt is difficult but certainly possible.

Large corporations – including car sales outlets, ironically – restructure debt frequently. Used-car company Carvana (CVNA) successfully restructured $1.3 billion in debt earlier this year to avoid bankruptcy. Individual borrowers should consider such negotiations too.

Meet your retirement goals effortlessly

The road to retirement may seem long, but with WiserAdvisor, you can find a trusted partner to guide you every step of the way

WiserAdvisor matches you with vetted financial advisors that offer personalized advice to help you to make the right choices, invest wisely, and secure the retirement you've always dreamed of. Start planning early, and get your retirement mapped out today.

Get StartedAnother alternative: yard sale

Based on the assumption that a family with four vehicles probably has more assets, Warshaw encouraged David to sell other possessions to raise cash. “Something tells me with these trucks and vehicles, you’ve got more stuff laying around to get rid of,” she said.

Exercise equipment, lawnmowers, furniture or anything with scrap value could be sold off to help rescue the family from this urgent situation and give them some breathing room.

The richest 1% use an advisor. Do you?

Wealthy people know that having money is not the same as being good with money. Advisor can help you shape your financial future and connect with expert guidance . A trusted advisor helps you make smart choices about investments, retirement savings, and tax planning. Try Advisor now.