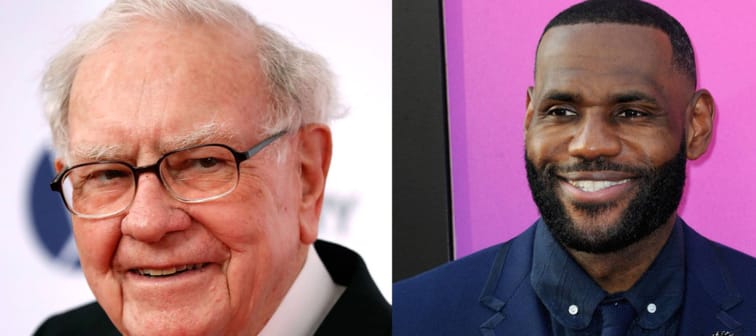

Buffett’s financial tips for James

Buffett famously offered some solid financial advice to the NBA star in terms of how to make the most of his hefty professional salary. “In terms of earning power, [he should] just make monthly investments in the low-index fund,” Buffett advised via CNBC’s Squawk Box in 2015.

He then suggested James “keep it simple” when investing.

For starters, the Berkshire Hathaway CEO said, James should consider investing primarily in American companies. “Owning the United States at a decent average price bought over time, you really can’t go wrong with that.”

Five years after this advice, James joined Buffett in the billionaires club, making him the only active basketball player to hit a net worth of more than $1 billion.

Granted, James already had a healthy bankroll to start off with: He made $765 million in the first 15 years of his pro basketball career. But he also became a shrewd investor, at one point turning an investment of less than $1 million in Blaze Pizza into more than $25 million in 2017.

“LeBron, in addition to a lot of other talents, [has] a money mind,” Buffett told USA Today in 2018. “And he gets stuff."

The good news is that you don’t have to be an NBA superstar to benefit from Buffett’s wisdom.

Here are four ways to make the billionaire CEO’s strategies part of your championship investing season.

Discover how a simple decision today could lead to an extra $1.3 million in retirement

Learn how you can set yourself up for a more prosperous future by exploring why so many people who work with financial advisors retire with more wealth.

Discover the full story and see how you could be on the path to an extra $1.3 million in retirement.

Read More1. Buy the same stocks that Buffett owns

Imitation, aside from being the most sincerest form of flattery, can sometimes provide a nice shortcut to riches.

Buffett is known far and wide for his adherence to value investing, which involves looking for established companies, often those where the stock trades for less than book value.

Bank of America, Coca-Cola and American Express are core holdings in Buffett’s portfolio.

2. Invest in an index fund

It’s right there in the name: index funds are pegged to the value of a particular index such as the S&P 500.

If the index goes up, so does the fund pegged to it, which makes it a simple way to take advantage of rising markets and instantly diversify. In essence, you’re buying all the stock in a particular index. In the world of investing, it doesn’t get much easier than this.

Buffett recommends index funds as a savings haven, especially in your retirement years.

Diversify your portfolio by investing in art

When it comes to investing, a diversified portfolio can lead to better returns. Masterworks' art investing platform has turned a previously inaccessible asset class into an actual option for individual investors. Think of artists like Banksy, Monet or Warhol. Get priority access and skip the waitlist here.

Skip the waitlist3. Buy and hold… and hold

In terms of how long Buffett likes to hang on to his investments, he famously said in a 1988 letter to his shareholders: “Our ideal holding period is forever.”

Holding onto stocks, especially during periods of market jitters, can have tremendous advantages.

You’ll avoid irrational selloffs or impulse moves and instead learn to trust in the wisdom that outstanding businesses compound your wealth year after year.

4. Read Benjamin Graham’s ‘The Intelligent Investor’

If you’ve ever wondered why Buffett has shunned the glitz of bitcoin and other unproven (or unstable) tech darlings, then check out the book The Intelligent Investor by Benjamin Graham.

Originally published in 1949, the book has served as Buffett’s investment bible. He’s called it “the best book about investing ever written.”

At its heart, The Intelligent Investor espouses a strategy of studying relevant facts about a business (particularly its past and estimated future profitability) to determine its true worth.

This 2 minute move could knock $500/year off your car insurance in 2024

OfficialCarInsurance.com lets you compare quotes from trusted brands, such as Progressive, Allstate and GEICO to make sure you're getting the best deal.

You can switch to a more affordable auto insurance option in 2 minutes by providing some information about yourself and your vehicle and choosing from their tailor-made results. Find offers as low as $29 a month.